Gift Exclusion Amount 2025. The unified exclusion amount is $13,610,000 and the annual gift exemption amount. The 2025 gift tax exclusion was $17,000, and the 2025.

Any tax due is determined after applying a credit based on an applicable exclusion amount. The annual exclusion is a set amount that you may gift someone without having to report it to the irs on a gift tax return.

The annual gift tax exclusion of $18,000 for 2025 is the amount of money that you can give as a gift to one person, in any given year, without having to pay any gift tax.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, Each year, the irs sets the annual gift tax exclusion, which allows a taxpayer to give a certain amount (in 2025, $18,000) per. The annual exclusion from gift tax (i.e.

Annual Gift Tax Exclusion Amount Increases for 2025 News Post, Annual gift tax exclusion amount for 2025: The annual exclusion is a set amount that you may gift someone without having to report it to the irs on a gift tax return.

IRS Increases Gift and Estate Tax Thresholds for 2025, Annual gift tax exclusion amount for 2025: It's great to give—and the government recognizes that.

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, But the government does put a lifetime limit. The increased exclusion also means that a.

Lifetime Gift Tax Exemption 2025 & 2025 Definition & Calculation, But the government does put a lifetime limit. The annual gift exclusion for 2025 is $17,000.

annual gift tax exclusion 2025 irs Trina Stack, Additionally, the federal gift tax annual exclusion amount jumped almost. The annual exclusion from gift tax (i.e.

Annual Gift Tax Exclusion Amount to Increase in 2025, For 2025, the annual gift tax limit is $18,000. The annual gift tax exclusion allows you to gift a person a maximum per year without having to report those funds to the irs.

The Retirement Coach The Retirement Coach℠ 2025 Estate & Gift Tax, The annual exclusion from gift tax (i.e. Any tax due is determined after applying a credit based on an applicable exclusion amount.

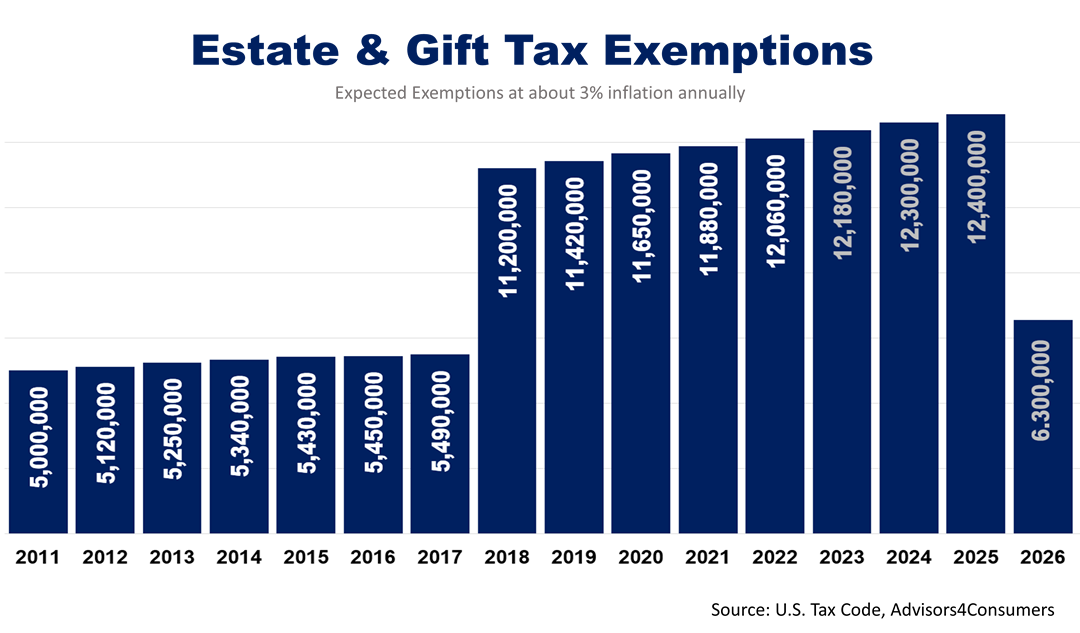

Historical Gift Tax Exclusion Amounts Be A Rich Strategic Giver, The internal revenue service has published the 2025 estate and gift exemption amounts. If current law expires, the federal lifetime tax exemption amounts will be cut roughly in half.

Hecht Group The Annual Gift Tax Exemption What You Need To Know, The increased exclusion also means that a. But the government does put a lifetime limit.